LemFi Credit

Credit That Works for You

Build your credit score with LemFi’s fair, transparent, and accessible credit Product.

LemFi Credit is provided by Abound. LemFi is not a lender.

Disclaimer: Missed or late payments may impact your credit score and result in additional interest payable.

Representative Example

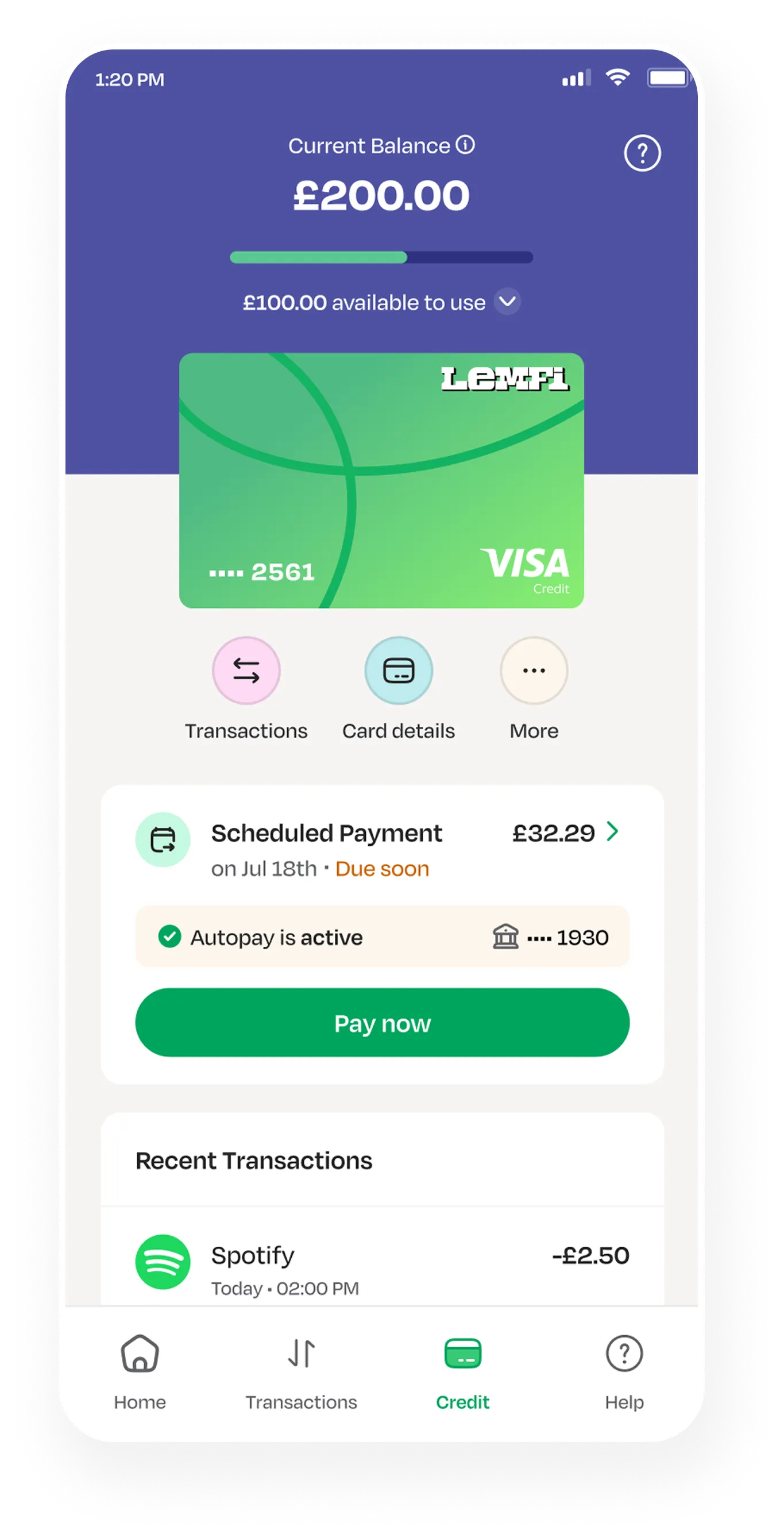

£1,200

Assumed credit limit

29.9%

Interest rate p.a. (variable)

29.9%

Representative APR (variable)

It is a better way to credit

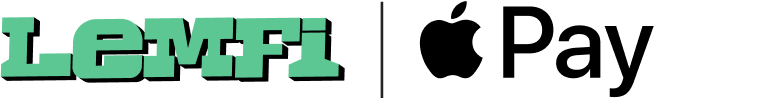

Flexible Credit

Enjoy flexible access to your credit limit, spend as needed and set a repayment date that works for you.

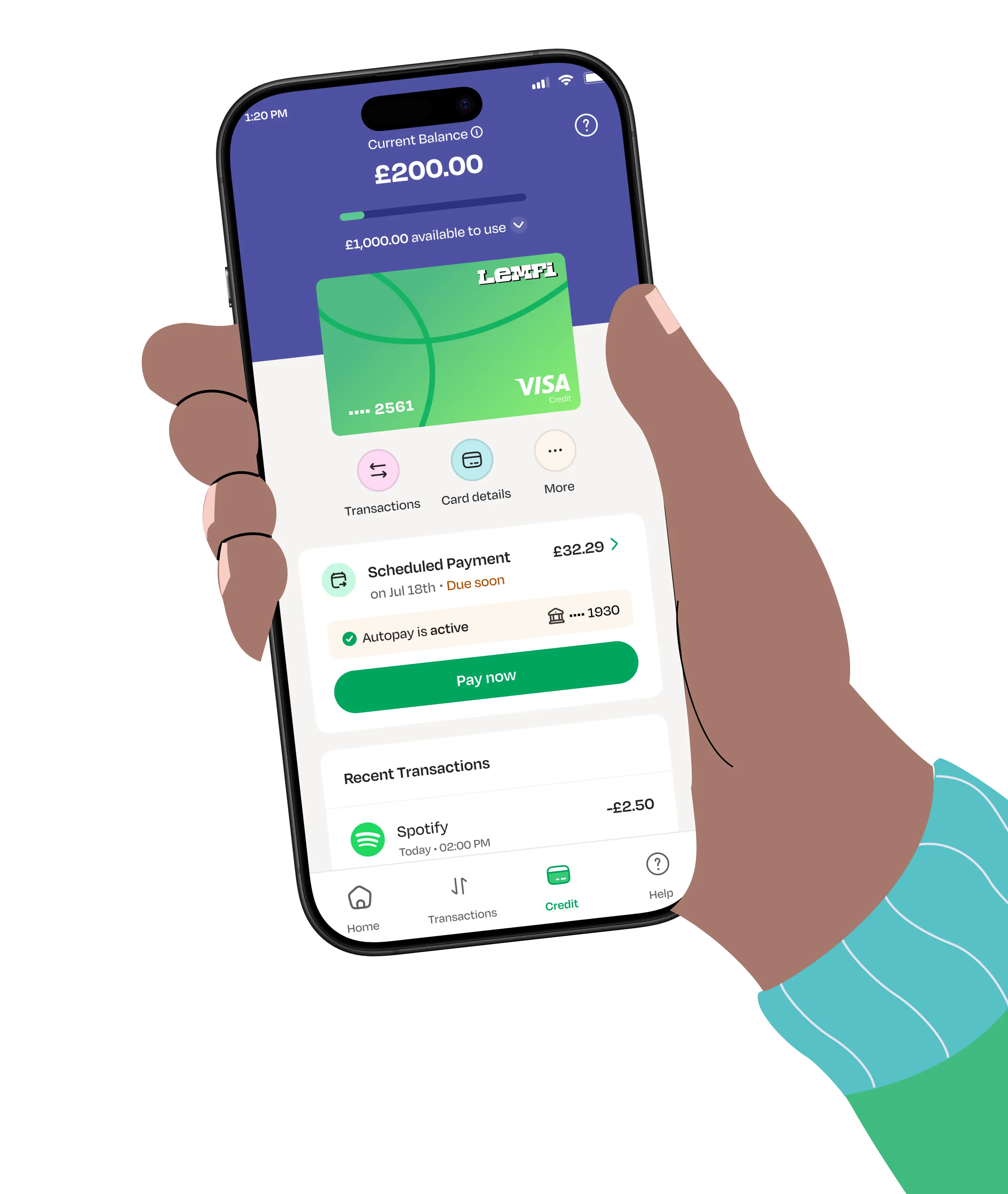

Easy 12-Month Instalment Plan

Every purchase is automatically split into 12 monthly instalments. Interest is calculated daily, meaning that if you repay early, you’ll save on the interest paid.

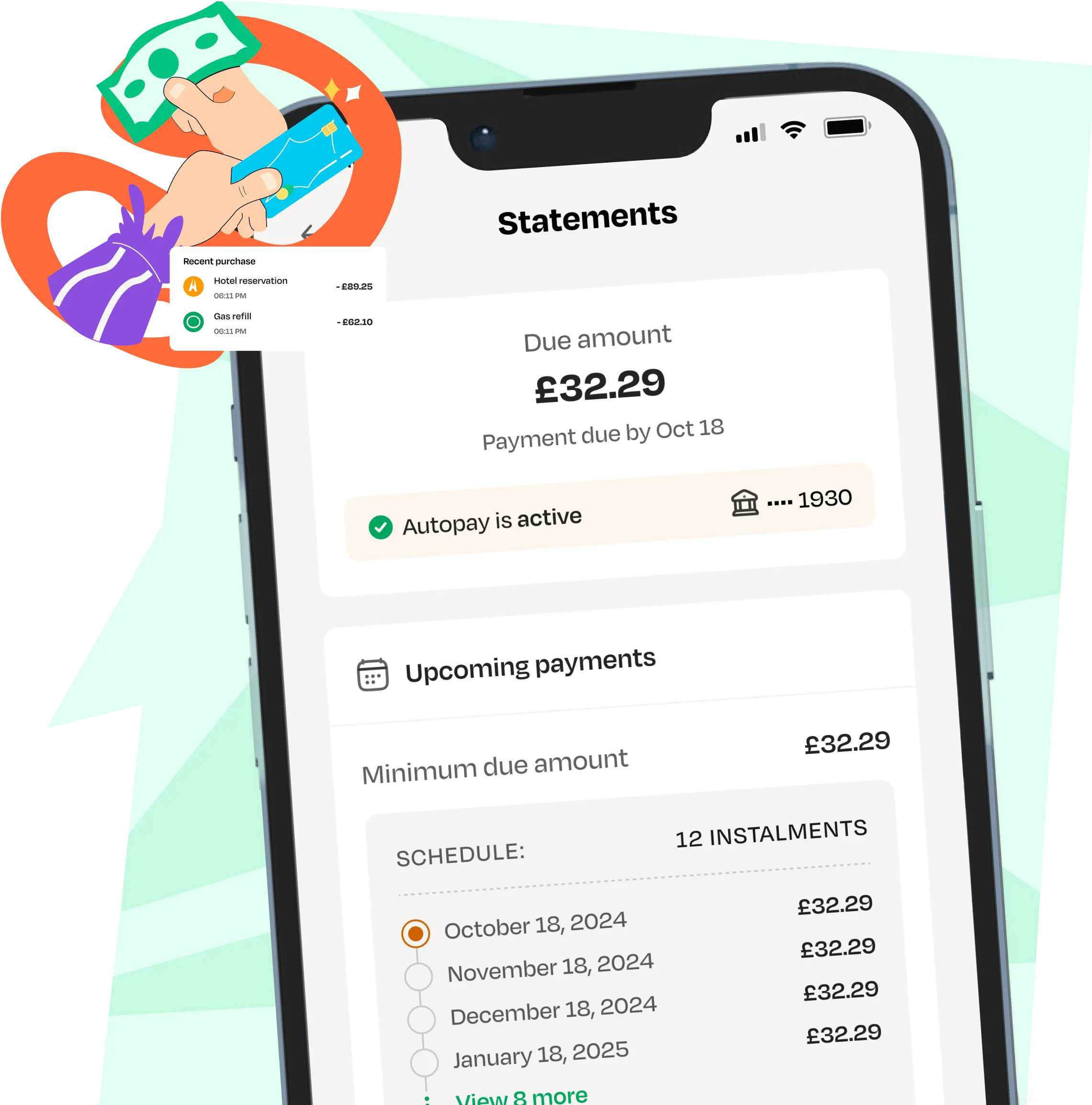

Get a virtual card

Once approved, provide repayment consent through Open Banking, and start spending immediately by adding your LemFi virtual card to Apple Pay or Google Pay.

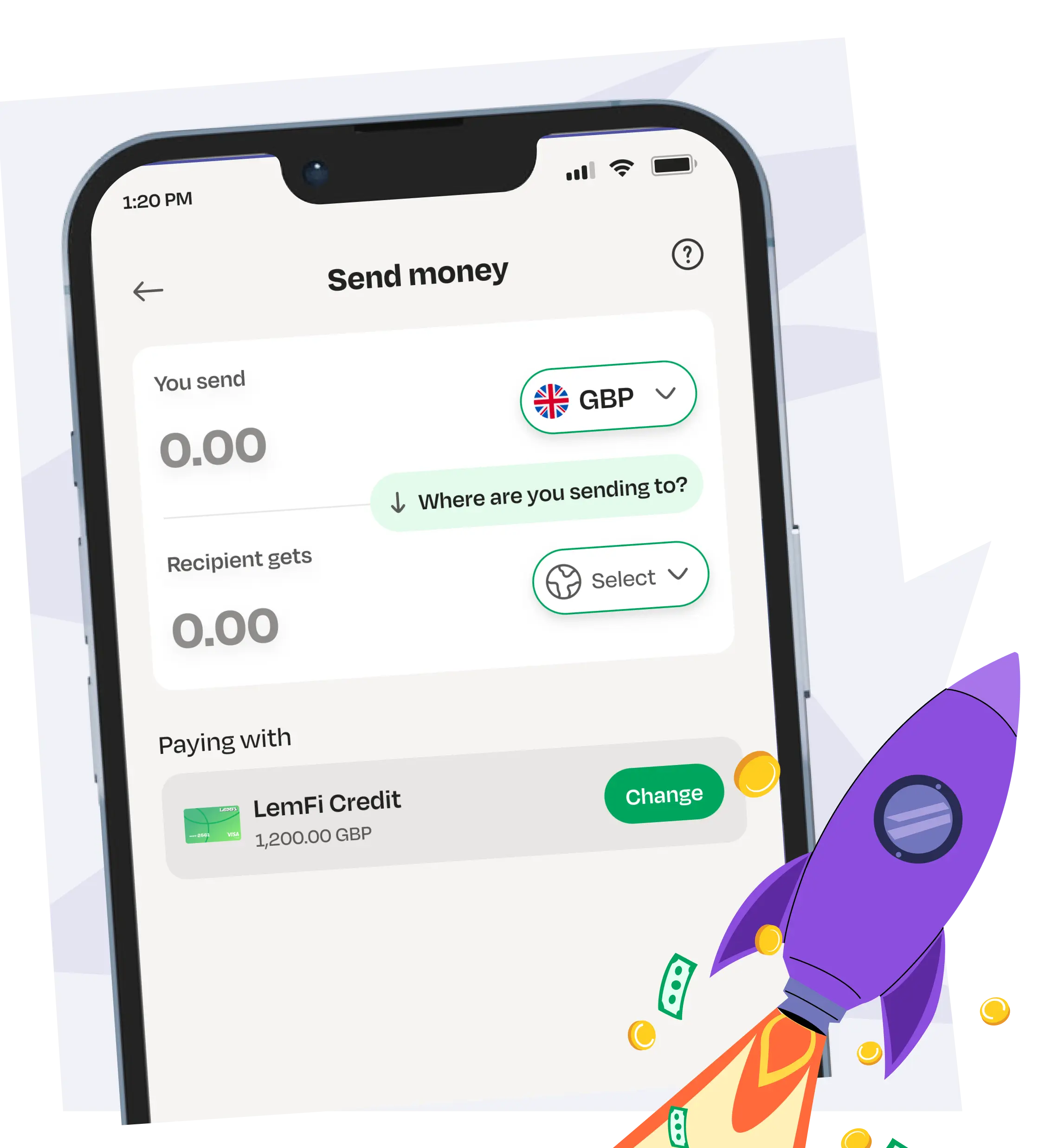

Send Now, Pay Later

Send extra money home when it matters most with LemFi credit then pay back later in easy monthly instalments. Fees and standard interest rates apply.

Quick And Easy Steps

How to get LemFi Credit

1. Check Your Eligibility

Fill in your details to see if you qualify. No impact on your credit score.

2. Verify Your Income

Securely connect your bank account to confirm your monthly income.

3. Get Approved

Once you have been approved, review the credit offer and sign your agreement.

4. Start Using LemFi Credit

Activate your virtual card, set up auto repayments, and begin building your credit history today.

Flexible Credit

How it works?

1. Revolving Credit Line

Access LemFi credit anytime with a virtual card.

2. 12-Month Installments

Every purchase is automatically split into 12 monthly instalments.

3. Monthly Automatic Payments

Monthly instalment are automatically collected on your chosen date4. Interest Application

Interest starts on the transaction date. Paying early lowers interest, with no penalties.All The Things to Love

About LemFi Credit

Build Credit Score

On time payments can help improve your credit score. Missing payments can negatively impact your credit score.

On time payments can help improve your credit score. Missing payments can negatively impact your credit score.No Sneaky Fees and 100% Transparency

No transaction fee, no late payment fee, and no secrets between us. You’ll always know what you’re paying.

No transaction fee, no late payment fee, and no secrets between us. You’ll always know what you’re paying.Send Now, Pay Later

Send extra money home when it matters most with LemFi credit then pay back later in easy monthly instalments.

Send extra money home when it matters most with LemFi credit then pay back later in easy monthly instalments.Impact-Free Eligibility Check

Check if you qualify for LemFi Credit without any impact on your credit score.

Check if you qualify for LemFi Credit without any impact on your credit score.Instant Access to Credit

Get approved, provide repayment consent through Open Banking, and start spending on your LemFi virtual card

Get approved, provide repayment consent through Open Banking, and start spending on your LemFi virtual cardWe’re Here for You, Every Day

Our support team is available 7 days a week to help with anything you need.

Our support team is available 7 days a week to help with anything you need.

Got questions?

Some of most frequently asked questions.

What is LemFi Credit?

LemFi Credit is a revolving credit line accessible through a virtual card that you can add to Apple Pay or Google Pay. It’s designed to help you manage your finances effectively and build a positive credit history. Please note that late or missed payments will be reported to credit reference agencies, which could negatively impact your credit score.

How is LemFi Credit different from a traditional credit card?

Can anyone apply for LemFi Credit?

I’ve just moved to the UK, can I still apply?

Are there any fees associated with LemFi Credit (e.g., late fees, over-limit fees)?

Who is Abound and Fintern Limited?

It's the best of credit.

Available on iOS and Android.